Terra Luna was supposed to be probably the best and most revolutionary blockchain altcoin ever seen by most investors for a long time. It fits perfectly with the evolution of crypto and is the coin that will make the crypto world move forward but What really happened to Luan Coin ? Why did it drop to almost $0.0001 ? We will try to uncover the real reasons behind this…

I have been into crypto market in a very long time and very familiar to most of the projects in the market. Some of the experienced crypto investors and analysts actually told me that what Terralab does is very familiar to 2008 mortgage situation in some ways… and I can relate this in many way especially with interest system.

Who are the Founders of Luna Terra?

In order to understand the big crash that caused thousand of luna investors to lose money, we need to know the founders of this coin: Terraform Labs.

South Korean firm Terraform Labs was founded in 2018 by Daniel Shin and Kwon, who are the CEOs of the company.

Prior to developing PTerra, Shin co-founded and ran Ticket Monster, also known as TMON, a major South Korean e-commerce platform. He then co-founded Fast Track Asia, a startup incubator that works with entrepreneurs to build fully functional companies.

They find that due to the volatility event, the seller does not want to sell something that can be valued later, and buyers do not want to buy a currency that can seriously decrease in value.

They found a solution to this and named it terra station. With this, the first decentralized currency/stablecoin was established. UST is for US dollar, KRT is for Korean won, EUT is for Euro.

Terra Labs also have Mir coin which allows investors to buy stocks using $mir coins (mAssets). We have a detailed article about Mirror protocol here.

What is Luna Terra? ( Luna Coin)

Luna coin is an algorithmic stablecoin platform running on a Proof of Stake (PoS) blockchain infrastructure built with Tendermint. LUNA is the token of the Terra platform and is used for the issuance of stablecoins (TerraSDRs) as a price stability mechanism, as well as for staking and network governance.

To offset the value of TerraSDRs with their respective pegged currencies, users can exchange LUNA tokens for TerraSDRs and vice versa.

I know this sound complex thats why I will try to explain it simple:

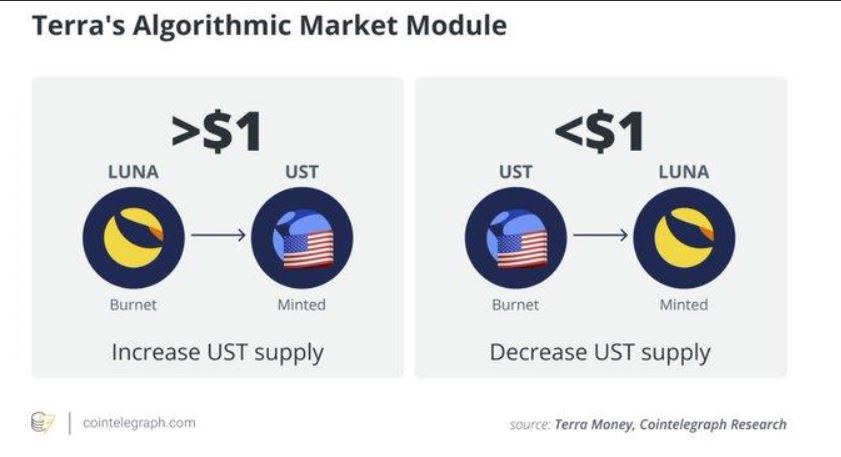

What we call luna is actually the value that is volatile and works with an algorithm built to produce stablecoins.

- 1 ust = 1 usd. Let’s say a Luna is worth $5. For this, it is necessary to burn 1 Luna to produce 5 Ust.

- The difference between usdt, busd and usdc is that it is decentralized. It cannot be blocked by states or should I say much more difficult. It was the 5th largest stablecoin.

- Here is a visual demonstration for how Luna works:

credit: cointelegraph

What Happened to Luna Coin? Why did it collapse?

Two things are absolutely necessary for the Ust-Luna structure and the equality of $ust to survive;

1-New investors

2-Current investors should not leave the Luna ecosystem.

To do this, you need to offer a staking program where you can convince investors that the opportunities within the ecosystem are better than the opportunities outside. That was the mission of the $Anc protocol.

Despite the abnormal interest rates in the $anc protocol, $anc did not see any increase in value even in the market structure that changed last month. While all the coins in the market were up 45-50% from their last lows, the rise in $anc was only around 15%.

There were two things that caused this;

1-) This system did not seem sustainable to anyone with these interest rates,

2-) $Anc was aggressively circulating coins according to the planned supply schedule, and unlocked investors were running from the lumbering $anc in the swirling market to other opportunities in the market. So $anc could not fulfill the mission assigned to it.

This situation made the stability of the Ust unsustainable. Because, according to the interest algorithms within $anc, the interest rate decreased as the amount of investors increased, and the interest rate increased as the number of investors decreased. in other words, higher interest had to be paid to fewer investors.

The logic behind this algorithm was based on the principle that the investor with high interest comes to $anc, and as the investor comes to $anc, the $ top interest decreases. If $anc had investors, it would have been easier to maintain the Ust parity.

However, to cover the interest paid as $Ust, it was necessary to mint $Luna and burn $Ust, in other words to find liquidity, in order to prevent the depreciation caused by selling pressure as $Ust is distributed, and to maintain the equality of $Usts to $1.

Minting luna means depreciating $luna. What kept $luna’s value was that when $ust went above $1, this time, $lunas were burned and $usts minted, so that’s our current algorithm.

what if the value of both $ust and $luna dropped at the same time? In this case, the Luna Foundation would step in and fund the Luna ecosystem using their BTC resource to use in this scenario. The budget allocated for this business was 1.2 billion dollars btc. . so what would happen if $btc fell simultaneously at the same time? the ecosystem would be engulfed in a death spiral.

In fact, this is exactly what we are experiencing….

Luna Coin Crash: Conclusion

Also, as I mentioned at the beginning of the article, in order for the Luna-UST ecosystem to survive, investors must enter and stay in the ecosystem.

Of course, this means that other market makers in the market will do whatever they can to topple Luna. actually this has been a problem for a long time because Luna was starting to dominate the market badly. This monopoly naturally prepared the end of other Defi projects and of course the disintegration of $luna means that the money from there will go into other projects, everyone wants to eat the same cake.

Not Investment Advice

The information provided in this article is intended for general guidance and information purposes only. Contents of this article are under no circumstances intended to be considered as investment, business, legal or tax advice. We do not accept any responsibility for individual decisions made based on this article and we strongly encourage you to do your own research before taking any action. Although best efforts are made to ensure that all information provided herein is accurate and up to date, omissions, errors, or mistakes may occur.

Disclosure: Authors are invested in cryptocurrency projects and have cryptocurrency holdings – including those covered on this website.