Before investing in altcoins, you should look at the project whitepaper, supply and demand elements, and the stakeholders behind the project. In this article, we will talk about what you should pay attention to when buying an altcoin.

- You must have a cryptocurrency account to buy any altcoin. Click to sign up for the world’s largest crypto exchange Binance: Binance

Table of Contents

What is an altcoin?

The word “altcoin” is derived from the words “alternative” and “coin”. Altcoins refer to all alternatives to Bitcoin. Altcoins are cryptocurrencies that share the same characteristics as Bitcoin (BTC). For example, Bitcoin and altcoins have a similar underlying framework. Altcoins also work like peer-to-peer (P2P) systems and share code like Bitcoin.

Of course, there are also distinct differences between Bitcoin and altcoins. One such difference is the consensus mechanism used by these altcoins to verify transactions or generate blocks. Bitcoin uses the proof-of-work (PoW) consensus mechanism, while altcoins often use proof-of-stake (PoS). There are different categories of altcoins and they can be best described by their consensus mechanisms and unique functions.

Here are the most common types of altcoins:

Mining-based coins

Mining-based altcoins use the proof-of-work method commonly known as PoW, which allows systems to generate new coins through mining. Mining requires solving complex problems to create blocks. Monero (XMR), Litecoin (LTC), and ZCash (ZEC) are examples of mining-based altcoins.

Stable coins

Stablecoins aim to reduce the volatility that has plagued crypto trading and usage since its inception. Therefore, the value of stablecoins is pegged to the value of a basket of goods such as precious metals, fiat currencies or other cryptocurrencies. The basket acts as a backup in case the cryptocurrency runs into problems. Dai (DAI), USD Coin (USDC), and Tether (USDT) are all examples of stable coins.

With the collapse of the stable coin UST, which is linked to Luna Coin, many people started to know stable coins much more closely.

Security coins

As the name suggests, a security token is similar to traditional securities traded on exchanges. They are similar to traditional stocks and represent equity in the form of ownership or dividends. Security tokens attract investors as their prices are likely to appreciate quickly.

Memecoins

Memecoins are so named because they represent a silly take on well-known cryptocurrencies. It is often mentioned by celebrities and popular influencers in the crypto space, and it is the type of coin that is famous for its sudden rise and fall. For example, the popular meme coins Dogecoin (DOGE) and Shiba Inu (SHIB), their prices are often raised by Tesla’s CEO and well-known crypto enthusiast Elon Musk.

Utility coins

Service tokens are used to provide services such as rewards, network fees, and purchases within a particular network. Helper tokens, unlike security tokens, do not offer parity. For example, Filecoin (FIL) is a utility token used to purchase storage on a decentralized storage network.

How are altcoins valued?

Altcoin fundamental analysis involves looking at and evaluating all available information on an altcoin. To fully understand and evaluate the best altcoins to buy, it is necessary to look at the use cases and network of the cryptocurrency, as well as the team behind the project.

When analyzing altcoins, or any cryptocurrency for that matter, the goal is to understand whether the asset in question is overvalued or undervalued. Overvalued assets should be avoided, whereas undervalued assets are more ideal. This is because overvalued assets are likely to underperform and return to their true value. Low-value assets, on the other hand, have more growth potential and can make you good money in the long run. A comprehensive analysis will help you make the best decision regarding your investment decisions.

Some useful information on how to analyze cryptocurrency before investing.

3 Steps to choose a solid altcoin

Step 1: Analyze the whitepaper and find the value proposition

Reviewing a coin’s whitepaper will provide a lot of relevant information such as use cases, goals, and the team’s project vision. The whitepaper gives you a good picture of how the altcoin will provide value for its users.

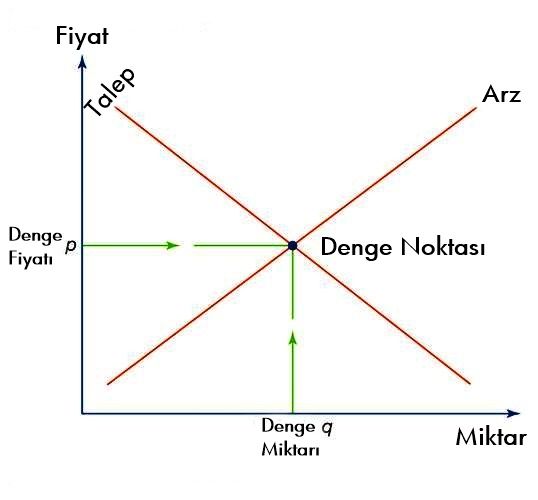

Step 2: Look for increased demand and stable (or declining) supply

Looking at supply and demand is one of the best ways to evaluate your next crypto investment. Now that you have a clear picture of how the altcoin adds value to its users, it’s time to take a look at how it’s driving supply and demand.

Simply put, the altcoin should have incentives to facilitate the increase in demand as the supply is constantly decreasing or stable. When demand exceeds supply, prices rise, which further increases demand.

Step 3: Evaluate the team and stakeholders behind the project

Now that you have a good understanding of what the project has to offer, it’s also important to thoroughly evaluate the team behind the project. You can find team information in the project whitepaper, but try to do independent research on them as well. You can check out the team page of the official project site and their LinkedIn profile, which they should make public and accessible.

When looking at each member’s history, ask the following questions:

- Have they worked on other reputable and successful projects in the past?

- What are the credentials?

- Respected members of the crypto community and blockchain ecosystem?

The aim is to find out if the team behind the project is made up of experienced experts who know what they are doing. You can look to on-chain analytics platforms and coin explorers to support your research on this. You can also browse their social media profiles or check out Twitter for the conversations they’re engaging in.

For example, Ethereum has a very strong investment community because every individual working on Ethereum creates value for Ethereum holders. Despite issues like high fees and slow transactions, developers, community builders, and other top talent still want to participate in Ethereum-related projects.